In US healthcare, understanding patient responsibilities is just as important as accurate insurance billing. For medical billing companies, clearly identifying and communicating patient responsibility helps providers collect payments faster, reduce confusion, and maintain healthy cash flow.

Patient responsibility refers to the portion of medical expenses that insurance does not cover and must be paid by the patient. These costs vary based on the patient’s insurance plan, coverage rules, and the type of services provided.

Table of Contents

What Does Patient Responsibilities Mean in Medical Billing?

Patient responsibility is the amount left after insurance processes a claim. Once the payer applies contractual adjustments, the remaining balance becomes the patient’s financial obligation. Medical billing companies play a critical role in calculating this amount correctly and explaining it clearly to patients.

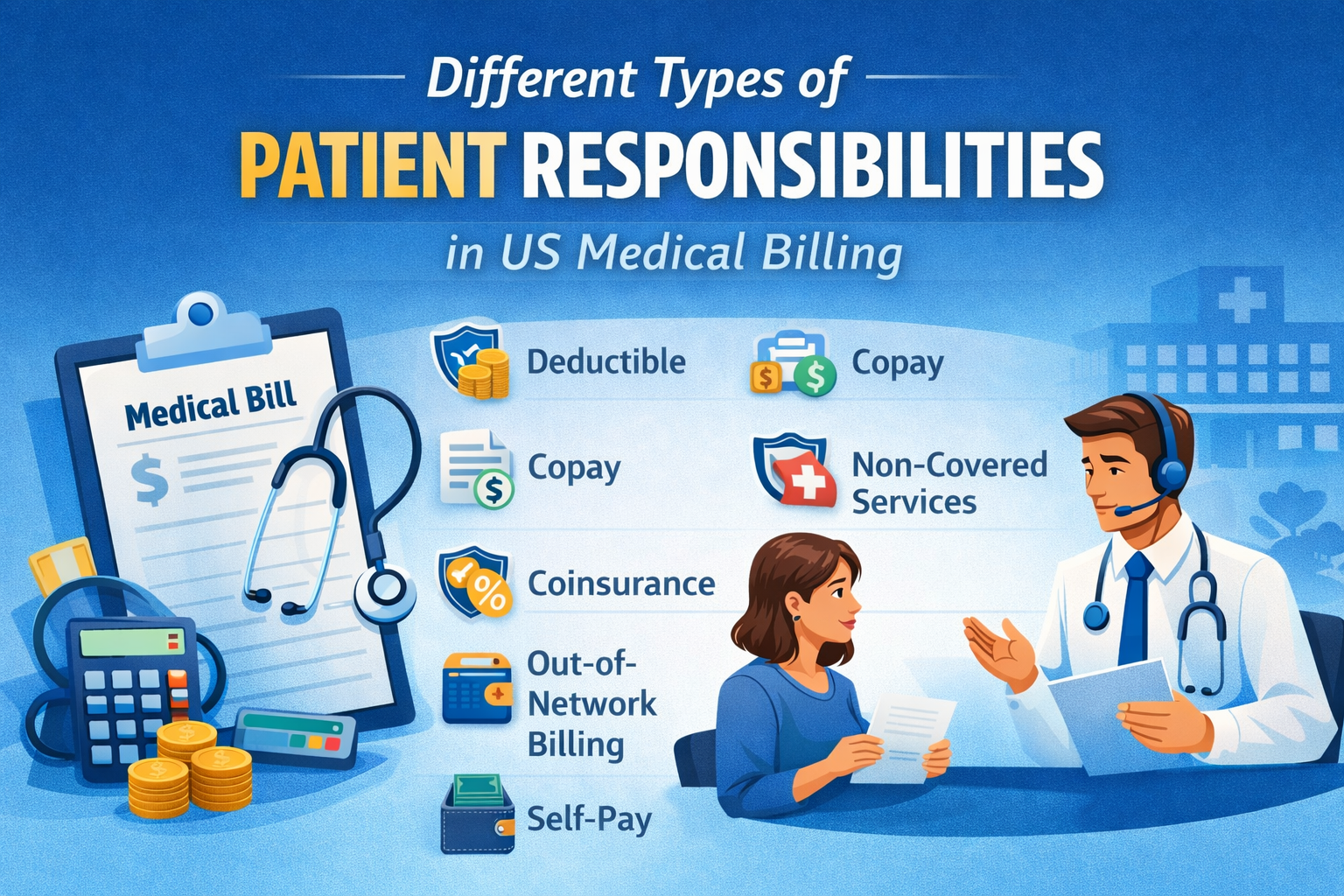

Common Types of Patient Responsibilities

1. Deductible

A deductible is the amount a patient must pay out-of-pocket before insurance begins covering eligible services. For example, if a patient has a $2,000 deductible, they are responsible for paying that amount before the insurer shares any costs. Deductibles reset annually for most insurance plans.

2. Copayment (Copay)

- Office visits

- Specialist consultations

- Prescription medications

3. Coinsurance

4. Non-Covered Services

Some medical services are not covered under insurance policies. In such cases, the patient is fully responsible for the charges.

Examples may include cosmetic treatments, elective procedures, or services excluded by the plan. Clear upfront communication helps prevent billing disputes later.

5. Out-of-Network Charges

When patients receive care from providers outside their insurance network, their financial responsibility usually increases.

This may involve:

- Higher deductibles or coinsurance

- Limited or no insurance reimbursement

- Balance billing for remaining charges

Medical billing companies must verify network status to avoid unexpected patient balances.

6. Balance Billing

Balance billing occurs when a provider charges the patient the difference between the billed amount and the insurance company’s allowed amount.

This typically happens with out-of-network providers, though federal and state laws may limit balance billing in certain emergency situations.

7. Self-Pay Responsibility

Self-pay patients do not have active insurance coverage and are responsible for the full cost of services.

Many providers offer:

- Discounted self-pay rates

- Payment plans

- Financial assistance options

Billing companies help structure these options to improve collections while keeping care accessible.

8. Outstanding Balances and Late Payments

If patient balances are not paid within the required timeframe, they may result in:

- Late payment fees

- Collection agency referrals

- Increased administrative follow-ups

Proactive billing and timely patient communication reduce these risks.

Why Patient Responsibilities are Critical for Billing Companies

Accurate patient responsibility calculation directly impacts a provider’s revenue cycle. When billing companies handle this process correctly, it leads to:

- Faster patient payments

- Fewer billing disputes

- Improved patient satisfaction

- Stronger provider-patient relationships

Clear explanations and transparent billing build trust and improve long-term financial outcomes.

Frequently Asked Questions (FAQs)

What is patient responsibilities in US medical billing?

Patient responsibility is the portion of healthcare costs that insurance does not cover and must be paid by the patient.

Who determines patient responsibilities?

It is determined by the patient’s insurance plan, benefits, deductible status, and the services rendered. Medical billing companies calculate it after claim processing.

Is copay the same as coinsurance?

No. A copay is a fixed amount, while coinsurance is a percentage of the total allowed charge.

Why do patients receive bills after insurance pays?

Insurance rarely covers 100% of costs. Deductibles, copays, coinsurance, and non-covered services create remaining patient balances.

How can billing companies reduce patient payment delays?

By verifying benefits early, explaining costs clearly, offering payment plans, and sending timely statements.

Final Thoughts

Patient responsibility is a core element of US medical billing and revenue cycle management. For billing companies, accuracy, clarity, and communication make all the difference. When patients understand what they owe and why, payments are faster, disputes are fewer, and provider revenue remains stable.

We offer end-to-end medical billing services, including patient demographics entry, insurance eligibility verification, charge entry, ICD-10 and CPT coding review, electronic claims submission, denial management, payment posting, and aggressive accounts receivable follow-up. Using advanced billing software, EDI integration, and payer-specific workflows, we ensure clean claims and faster payment cycles.